My CFP® Journey - A personal story

To get where you want to go, sometimes you have to go the long way around. Life doesn’t necessarily cooperate with your plans, detours happen, and other times you just lose your way. That’s what happened to me, though I still managed to arrive at my destination, albeit a little later than I would have preferred.

When I graduated high school in 1985, I knew I wanted a career that had to do with money, but I wasn’t ready to start college, so I took a year off and just worked. In 1986 I started at a small school (University of North Alabama), pursuing a double major in Finance and Accounting. As far as I knew then my future was as a CPA but life had other things in mind.

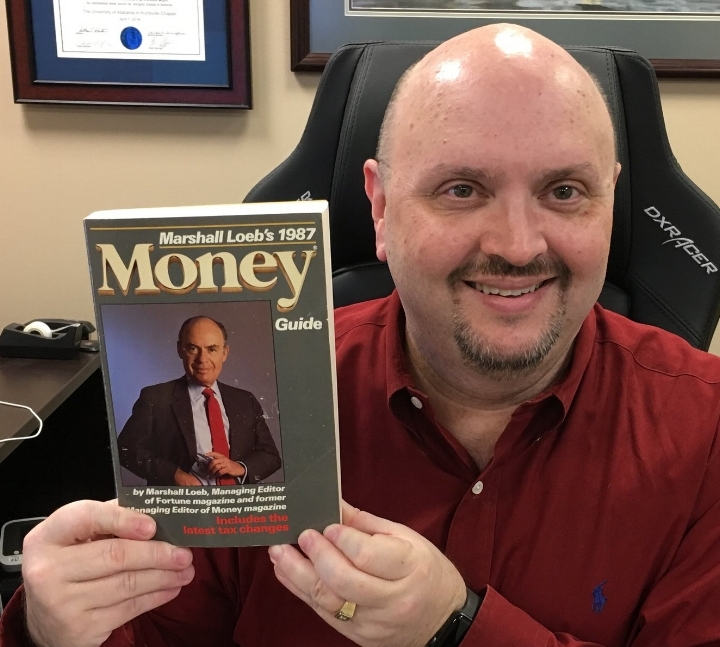

It was spring of 1987 when I was spending an evening relaxing (in the bathtub but that’s enough of that) and reading a book but not just any book though, it was “Marshall Loeb’s MONEY Guide for 1987”, a copy of which I still own…

Not my original copy of course. I didn’t have the foresight to save it when I was 20 :-)

In that book was a section on a concept that struck me as new, something called a “financial planner” and it even described a professional designation called a “Certified Financial Planner” or CFP® that was the gold standard for this particular profession. I read that book twice that summer and the seed of my becoming a financial planner, specifically a CFP®, was sown.

Marshall Loeb’s “MONEY Guide 1987” and his advice for finding a financial planner. I think there are a few more of us these days :-)

I never finished college that time. In summer of ’87 my older brother was killed in a car wreck and I left college to go back home. After my brother passed, my mom couldn’t stand the thought of me driving back home every other weekend.

I tried going back to school at the local university (University At Home it was called then) but I just really didn’t want to be there, so I didn’t stick with it. Instead I took my part-time job as a computer technician to full-time status and never went back. The one thing my mother made me promise was that I would get my college degree before she passed away; she wanted to see me graduate. I made that promise, not really knowing if I would ever get around to fulfilling it.

I spent the next few decades immersed in the fast-moving world of technology, finally finishing as a network and telecommunications engineer. It was while I was working at my last company that I decided I had no more excuses. The company offered a tuition reimbursement plan for ANY undergraduate program, so I started going back to school on a nights and weekends basis in 2009.

If any of you have done the “non-traditional” student thing and gone back as an adult, you have an idea of what was about to happen. Here I was, 42 years old, and starting again at the local community college (fyi, WAY cheaper than going straight to the 4-year school). For the most part I was always the oldest person in the room, which I expected. It was sobering but expected. What I didn’t expect was the fact that I was a MUCH better student than I ever had been before.

In high school I was a C student because I was bored, plus I was normally working 30-40 hours per week. I couldn’t see the value in high school and I was too preoccupied to care. When I was at UNA I was doing well but I left too early to really see the end-game. Suddenly I’m older, I know why I’m going back, what it will take, and what the value of it was for me; only then did I become a straight-A student.

Fast-forward a bit and I get my associates degree in business (2011) and my mom gets to see me graduate; promise fulfilled mom - love you.

But I wasn’t done. Things were going so well that I couldn’t see myself stopping, so I transferred to the “big school” and kept at it. I finished my BS in Accounting in 2014 and mom got to see me graduate yet again. Bonus to the whole thing was that my wife had gone back to get her masters and we managed to graduate together. Yay for being college sweethearts, even if we were already married!

Now the end was in sight. I had laid the ground work and pulled it off, so I applied to the University of Alabama Graduate School for a Masters of Family Financial Planning & Counseling and was accepted. I swore to myself that I’d graduate before I turned 50; I graduated in Spring of 2016, two months after I turned 49, with a 4.0. To top it all off, mom got to come with me to Tuscaloosa, AL and watched me graduate for a 3rd (and final) time.

All that was just to BEGIN the process of getting my CFP®; I needed work experience and I was still working in the technology field.

As fate would have it, I had secured an internship in the final year of my graduate program with Scott and ColeFP, and he was interested in bringing me into his firm upon graduation. He and I shared a similar disposition and outlook on the industry, so it seemed a good fit. I started doing some part-time work for him (nights and weekends) while I arranged to begin winding down my technology career, for the eventual transition to a full-time financial planner in July of 2017.

To become a CFP® normally requires 6,000 hours of experience but because I was working under the guidance of an existing CFP® my experience qualified as an Apprenticeship, which meant that I only needed 4,000 hours. Still quite the hill to climb but on October 12, 2018, I ticked that last box and fulfilled my experience requirement, finally becoming a CERTIFIED FINANCIAL PLANNER™ 31 years after learning such a thing existed.

Why tell this story? A few reasons, for anyone that might have read this far:

· Never give up on your dreams, no matter how old you are

· Don’t let the fact that your path takes many a twisted route to your destination keep you from achieving. It’s easy to look back with regret at the road you didn’t take but there’s nothing saying you can’t change course right now.

· Getting there late is better than not getting there at all.

Now I get the privilege of spending my remaining working years doing what I originally wanted: helping people understand their money and make it work for them. If I can use my life experience and my education to help people get their financial lives under control and less stressful, I figure that’s not a bad way to wrap up a career.